Originally posted in The Daily Star on 14 August 2024

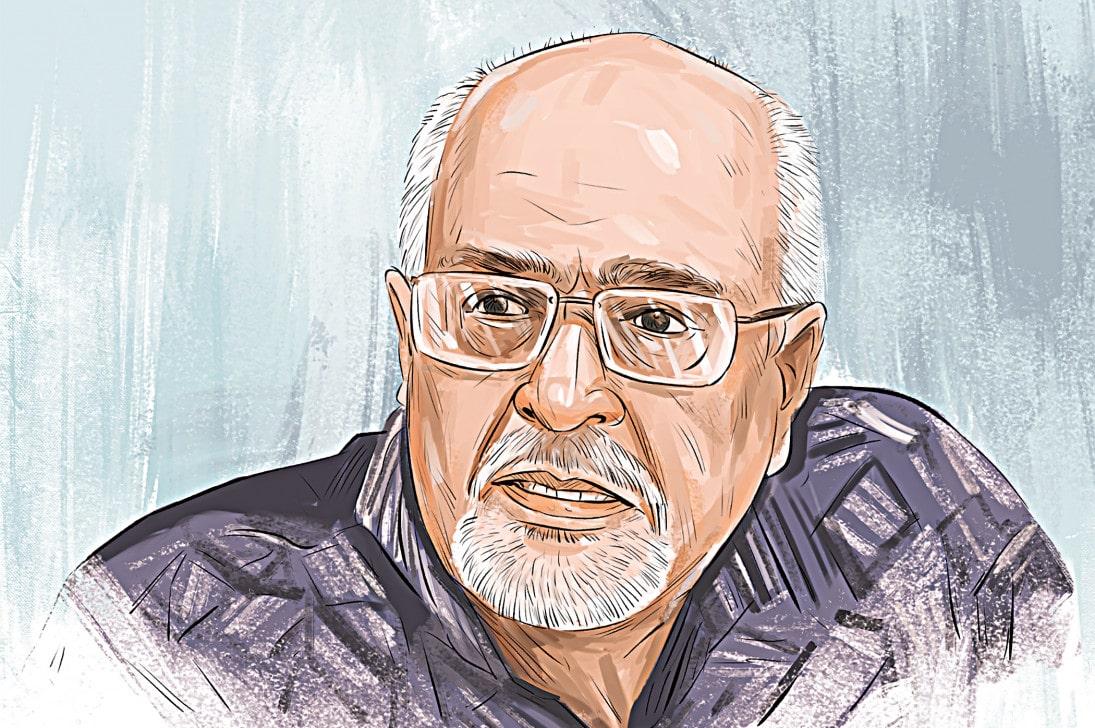

Interim govt should prepare a white paper, says Debapriya Bhattacharya

The interim government should prepare a white paper on the economy and identify sectors that require immediate attention, according to Dr Debapriya Bhattacharya, an eminent economist and public policy analyst.

“It should prioritise mitigating recent shocks to stabilise the economy before going for structural reforms to the banking sector, capital market, energy sector, revenue collection and public expenditure,” he said.

A white paper is an assessment report that features potential plans and policies to address the identified issues.

Bhattacharya suggested that such an initiative would help the interim government, headed by Nobel Peace Prize laureate Muhammad Yunus, to better understand the magnitude of existing challenges.

“The interim government needs to understand the state of the economy because if it does not establish a starting point, it cannot be credited for any improvement or blamed for deterioration.”

In an interview with The Daily Star on Sunday, Bhattacharya said an advantage of preparing a white paper is that it engages stakeholders through an open consultative process.

This not only informs them about the state of affairs but also raises awareness about what to expect.

Another benefit is that the planning and policy options provided are not official commitments and may be amended if necessary, Bhattacharya said.

HOW IT CAN BE PREPARED

Bhattacharya said it is expected that a white paper will be drafted by a group of competent people within a certain timeframe, which may be a maximum of two months.

The voluntary engagement of experts through such an inclusive process will also show the convening power of the government and generate confidence, particularly in the private sector.

Citing that Bangladesh’s international development partners and investors should be consulted as well, Bhattacharya said the process may assuage concerns centring the economic uncertainty.

He also said that the concerned ministries should provide their input.

“The energy ministry has already prepared a note for the new government. Among others, similar notes have come from Bangladesh Bank and the ministries concerned with finance, commerce, agriculture and social welfare,” he added.

A review of available real-time technical data inputs and consultation with stakeholders would provide a good basis for a much-required benchmark analysis of the economy.

MAJOR CHALLENGES AND URGENT PRIORITIES

“As the country has settled down with the coming of an interim government, it is now time to give attention to economic issues,” said Bhattacharya, also a distinguished fellow at the Centre for Policy Dialogue.

“I see three types of priorities in the economy at this moment. The first is mitigating the economic shock caused by the recent movement. This is a key issue that should be dealt with to get the economy back up and running,” he said.

The second is stabilising the adverse economic trends seen in the recent past, particularly inflation and supply chain disruptions as well as rising exchange and interest rates.

The last is initiating much-awaited wholesale structural reforms. It concerns on a priority basis the banking sector, revenue collection, quality of public expenditure, and so on.

“Mitigating the most recent shocks should be the immediate concern. This would entail the functional restoration of supportive institutions for the economy,” Bhattacharya said.

Also, ensuring smooth port operations and clearing the container backlog will be critical.

“Once we have dealt with immediate shocks, we can move to the stabilisation issues. However, there is no silver bullet to solve inflation,” he added.

Bhattacharya said it is more important for now to ensure an adequate supply of essential commodities in the domestic market.

“Maintaining the commodity supply from both domestic sources and international sources is very important in this case,” the economist added.

However, related issues include the rising exchange rate for US Dollars and poor market monitoring.

Most importantly, remittance flow must be enhanced and whether the price of foreign currency is appropriate, Bhattacharya said.

He added that these measures could help reduce the forex crisis to not only facilitate imports but also debt payments.

Bhattacharya urged the authorities to take a closer look at the financial sector to ensure that bad loans stop rising.

Regarding structural reforms, Bhattacharya said this demands a bit more preparation by the government as it has to take only those it can fulfil during its tenure.

So, since the tenure of the interim government remains a bit uncertain, it is very difficult to say how ambitious the structural reform programme should be, he added.

Nonetheless, reforms in the financial sector and capital market should be prioritised.

Following that, the most important will be reforms to the energy sector. The third priority is public finance management, with its two components being revenue mobilisation and impactful public expenditure.

“Indeed, the economic ambition of the interim government will be tampered with by the reality on the ground and its deployable capacity,” Bhattacharya said.