Published in Dhaka Tribune on Tuesday, 7 June 2016

RMG export strides against all odds

Ibrahim Hossain Ovi

Apparel export will predictably cross this fiscal year’s target as the earning is already more than $25bn with one month left before another year begins, according to latest official figures.

Apparel export will predictably cross this fiscal year’s target as the earning is already more than $25bn with one month left before another year begins, according to latest official figures.

The target was set at $27.37bn for the FY2015-16 after earning $25.49bn in last fiscal.

After Rana Plaza tragedy in 2013, observers prophesied that the country’s biggest export industry might face severe image crisis and suffer loss of global market share.

But it has continued to shine ever since as a lot of investment has been made to improve factories’ safety standards with the help of its Western retailers.

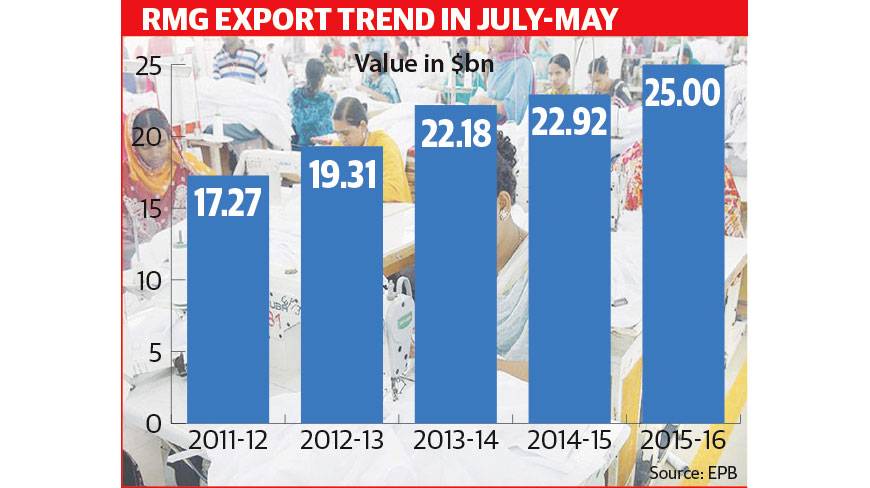

This demonstrates in the sector’s nearly 9.44% growth to reach $25.08bn in first 11 months of the current fiscal year.

RMG makers believe improvement of safety standards and progress of remediation work in factories have helped to restore buyers’ confidence.

Now if the RMG wants to further accelerate the growth in the years to come, experts think focus should be given on productivity, manufacturing medium and higher-end products and exploring markets other than traditional ones.

“RMG makers should focus on workers’ productivity and value-added products to maintain targeted growth as productivity of Bangladeshi RMG workers is still less than that of the competitors,” Khondaker Golam Moazzem, additional research director of think tank Centre for Policy Dialogue, told the Dhaka Tribune. He added the country was still producing low-end and basic products.

It was feared that the RMG export might fall due to safety inspection, but the sector didn’t stop posting healthy growth as the inspection found only less than 2% of factories vulnerable.

“Confidence has been restored among global buyers as the number of risky factories found in the inspection by Accord and Alliance is less than the buyers’ assumption,” Mohammed Nasir, vice president of BGMEA, said.

He said after the Rana Plaza collapse, most of the Bangladeshi garment factories were tagged as vulnerable in terms of workers’ safety. “But now the safety inspection found only 39 factories are risky, which are already closed.”

Nasir said following the inspection, the buyers placed more orders, which helped to increase earnings from apparel export.

However, he expressed concern over the continuous fall of products’ prices in the major global markets including the United States.

Nasir said the proposed hike of tax at source would pour salt on the existing wounds by pushing up production cost. “As a result, the sector people will also lose competitive edge.”

Khondaker Golam Moazzem suggested diversification of products such as cotton to non-cotton, which would give more margin.

He also emphasised exploring non-traditional markets as traditional markets have been on downward trend. “Besides, for expansion of business, production of higher-end products with innovation should be focused on.”

According to provisional data of Export Promotion Bureau (EPB), of the total amount earned in last 11 months, woven products fetched $13.16bn with a 12% growth and knitwear products $11.92bn with 6.74% from the same period last year.

The total export earnings posted nearly 9% growth to $30.66bn in last 11 months compared to $28.14bn a year ago. The figure is 1.47% higher than the $30.22bn target set for the period.

For the current fiscal year, the government has set a target of $33.50bn as total export earnings.

In May, the earning was $3.02bn registering 6.54% growth from $2.84 a year ago.