Originally posted in The Daily Star on 30 September 2025

Poor management and weak governance have long posed significant challenges to Bangladesh’s banking sector, as evidenced by various indicators. As a result, the sector’s overall performance has suffered, its efficiency and soundness declining over the years. Since the country’s financial system mainly relies on banks, the sector’s poor health presents a significant risk to economic growth. In recent times, the Bangladesh Bank has been implementing several reform measures to improve the sector’s health. These include restructuring the boards of several weak commercial banks, forming task forces, revising the Bank Company Act, adopting the Banking Resolution Ordinance, 2025, and revising the Bangladesh Bank Order, 1972, among others.

Poor management and weak governance have long posed significant challenges to Bangladesh’s banking sector, as evidenced by various indicators. As a result, the sector’s overall performance has suffered, its efficiency and soundness declining over the years. Since the country’s financial system mainly relies on banks, the sector’s poor health presents a significant risk to economic growth. In recent times, the Bangladesh Bank has been implementing several reform measures to improve the sector’s health. These include restructuring the boards of several weak commercial banks, forming task forces, revising the Bank Company Act, adopting the Banking Resolution Ordinance, 2025, and revising the Bangladesh Bank Order, 1972, among others.

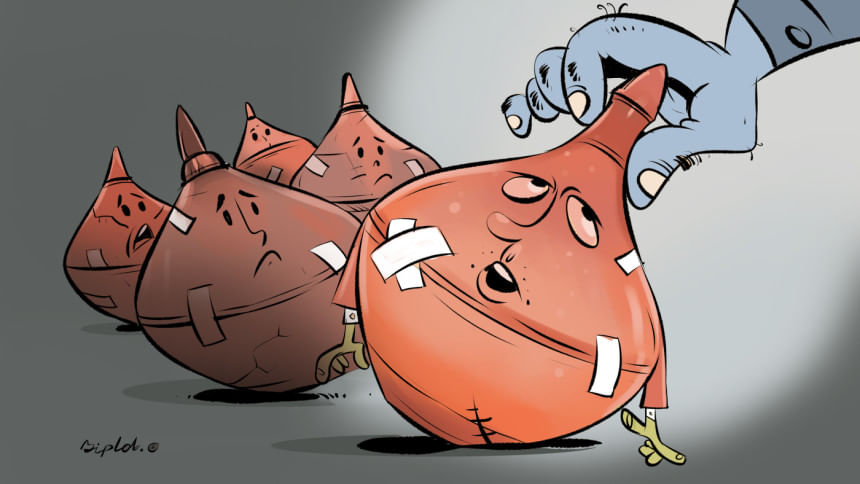

As part of reforming the commercial banks, the central bank has launched asset quality review (AQR), aiming to evaluate the true financial health of the banks and the actual amount of bad loans. In the initial phase, six banks—First Security Islami Bank, Global Islami Bank, Union Bank, Exim Bank, Social Islami Bank, and ICB Islami Bank—were assessed by global audit firms Ernst & Young and KPMG. Their AQR results show significant underperformance, highlighting issues such as capital shortfalls, high levels of classified loans, large provision gaps, and liquidity shortages. As a result, these banks have failed to pay their depositors and return funds to their lenders, which has badly shaken public confidence in the banking sector. This presents a serious threat to the stability of the country’s financial system.

The urgency of a bank merger arose in the face of the above-mentioned banks’ troubled financial health revealed by their AQRs. For years, these banks had presented sanitised financial statements that masked the true scale of bad loans. The AQRs revealed that, in some cases, the actual amount of non-performing loans (NPLs) were even four times higher than reported. In light of these developments, the central bank recently decided to merge five of these banks under the Bank Resolution Ordinance. The goal is to create a stronger bank with higher capital that can effectively serve its customers, handle the losses, and restore public trust.

According to the Bangladesh Bank, the merged bank, proposed to be named the United Islami Bank PLC, will have assets amounting to around Tk 232,319 crore, which is 8.4 percent of the total assets in the banking sector. The projected approved capital will be Tk 40,000 crore, with a paid-up capital of Tk 35,000 crore. The central bank has developed a 10-year business plan for implementing the bank merger, which focuses on strategies to attract capital, encouraging strategic investors and increasing loan recovery, policy support, and refinancing facilities, among others. The central bank expects the merger to be completed within two years. A team of one administrator and four officials from the central bank will be in charge of each of these five banks to supervise and monitor the merger.

The merger announcement has caused both relief and concern among the customers. There is relief because the loss of confidence in the five troubled banks became serious. Merger is expected to eliminate redundancy and increase efficiency. A larger balance sheet may enable the merged bank to fund larger projects, which in turn can contribute towards infrastructure development and economic growth. The psychological impact is also important. A merged, recapitalised bank under the supervision of the banking regulator provides a lifeline to depositors who have lost confidence, particularly small savers.

On the other hand, poorly executed mergers could create further problems, and the initiative could end up carrying the past failures over instead of building a stronger institution. Therefore, optimism regarding the bank merger must be weighed against significant challenges. Combining five banks that are each individually weak does not necessarily create strength. Therefore, the stakes are very high in this case. In an economy where banks control most of the financial intermediation, the health of the banking sector directly impacts investment, job creation, and growth. If the merged bank succeeds, it could restore depositor confidence, attract strategic investors, and serve as a model for broader consolidation in an overcrowded banking industry. But if it fails, the country risks creating a “too big to fail” institution burdened by legacy issues, draining public funds and further eroding trust.

For a healthy and strong bank through the merger, several preconditions must be met. First, the proposed plan must be followed strictly and cannot be deviated from under pressure from powerful groups and the political government. The central bank’s independence must be maintained throughout the merger process. Second, the operational costs of the bank must be lowered through efficiency and productivity. Third, the overall governance of the country must be improved. The banking sector cannot operate in isolation; it is part of the entire economic and political system. Therefore, establishing the rule of law and good governance through a strong democratic process, where public representatives are accountable, is a precondition for successful reforms in the banking sector.

The risk associated with the merger is a significant challenge to reducing the loan default rate. According to the Bangladesh Bank, the combined NPLs of these five banks will be as high as 79 percent of their total disbursed loans. If the merger succeeds, other struggling banks can also be merged and made profitable. If the central bank maintains its strong stance, enforces accountability, and carries out the plan with discipline, the country’s banking crisis may finally see some resolution.

Bangladesh has too many banks for its economy size, which is around $450 billion. What the country needs are fewer, stronger, better-run institutions. The bank merger presents a chance to create a precedent for that transition. Even with over 60 banks, the number of unbanked population in the country is high. The banking services are not equally provided to all customers either. While large businesses could avail high volumes of loans and become wilful defaulters, small and medium-sized businesses, without noticeable political connections, could not access funds. Therefore, the issue of accountability is very important for the banking sector. Until those who mismanaged or looted these banks are duly punished, public trust will remain low. The country cannot afford returning to the past banking culture that rewarded the reckless and punished honest savers.

The reform in the banking sector cannot succeed without broader governance reform. Weak rule of law, political influence over the regulators, and entrenched patronage networks have long undermined Bangladesh’s financial institutions. Unless these systemic issues are addressed, no merger, however bold, will bring about lasting changes.

Dr Fahmida Khatun is executive director at the Centre for Policy Dialogue (CPD). Views expressed in this article are the author’s own.