Published in The Daily Star on Monday 24 June 2019

Current account deficit shrinks 35pc to $5b

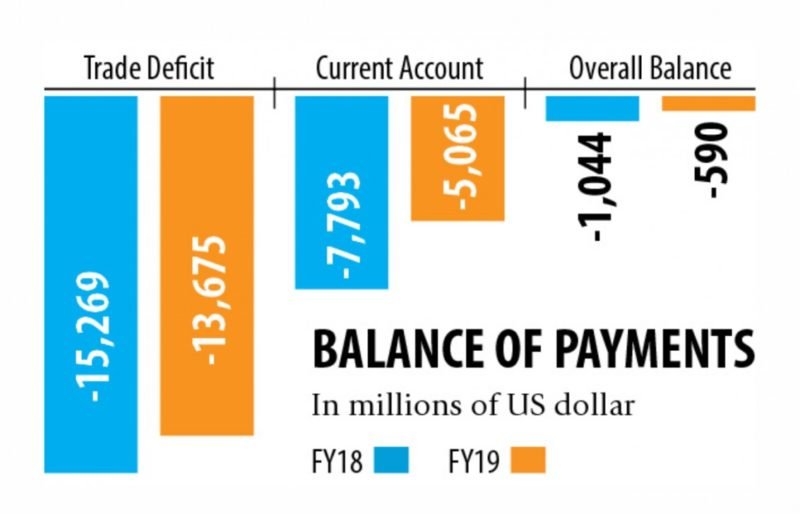

Bangladesh’s current account deficit continues to pose risks to macroeconomic stability despite its 35 percent fall in the first 10 months of the outgoing fiscal year.

The gap stood at $5 billion between July last year and April this year, according to central bank data.

The current account records a nation’s transactions with the rest of the world — specifically its net trade in goods and services.

The government should explore solutions immediately on how to stop the large deficit in the current account, or else it will face a wide range of crisis to keep the economy stable in the years ahead, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

If the trend is maintained in the remaining two months of the fiscal year, the overall deficit may hit nearly $8 billion, he said.

The government has to borrow from external sources to manage the deficit in the current account, which is not a good indication for the economy, said Mansur, also a former economist of the International Monetary Fund.

To tackle the situation, the government has to either increase exports or decrease imports, he said, adding that remittance can also play a good role in reducing the gap.

But, there is a little scope for decreasing imports as it increased 3.88 percent year-on-year to $47.10 billion during the July-April period.

“This is the actual import growth that is needed for the country,” Mansur said.

Last fiscal year, imports posted 16 percent growth, which is highly abnormal considering the volume of the country’s economy.

A large amount of money might have been laundered in the form of over-invoicing, which ultimately fuelled the import figure in the last fiscal year, Mansur said.

Between July and April, trade deficit also narrowed 10.43 percent year-on-year to $13.67 billion.

Despite the downward trend of both trade gap and current account deficit, there is no breathing space for the government, said Fahmida Khatun, executive director of the Centre for Policy Dialogue.

“The trade and current accounts are still big considering the country’s foreign exchange volume.”

Any country must maintain foreign exchange reserves to make import payments for at least three months and Bangladesh’s reserves now are good for at most 5.3 months’ bills, down from 5.9 months a year ago, she said.

“This has sounded the alarm bells.”

The government should take initiatives promptly to give a boost to exports in order to ward off the brewing tension, she said, while calling for exploring new markets.

The decline in imports is good for the economy, said AB Mirza Azizul Islam, a former adviser to a caretaker government.

The government should maintain the trend with a view to narrowing down the deficit in trade and current account.

But the heavy decline in industrial raw material imports is not a good sign as it will have a negative impact on industrial expansion and employment generation.

“The authorities should give importance to the issue in a bid to ensure the ongoing growth momentum,” Islam added.