Despite continued growth in Bangladesh, inequality and unemployment have not improved. Macroeconomic stability is also under pressure owing to creeping food inflation, high banking interest and high import payments lending to negative the Balance of Payment. Moreover, crisis in the banking sector and volatility in the capital market continue to persist. These are the major observations of the Third Reading of Independent Review of Bangladesh’s Development (IRBD) prepared by CPD. The first and the second readings of IRBD were published in January and April, of this year.

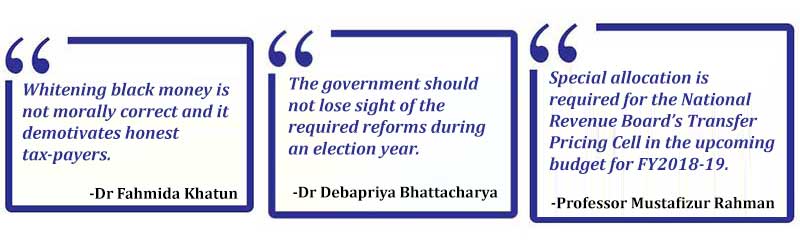

The Third Reading of the IRBD titled, “State of the Bangladesh Economy in FY2017-18” was launched at a media briefing on 3 June 2018 at BRAC Centre Auditorium. Professor Mustafizur Rahman, Distinguished Fellow, CPD, presented the report while Dr Fahmida Khatun, Executive Director, CPD chaired the event. Dr Debapriya Bhattacharya, Distinguished Fellow, CPD, made analytical comments on the report while answering to questions from the journalists.

The IRBD report emphasises on consolidating of macroeconomic stability and reducing all types of inequality in the coming years.

Overview of the Report

Areas of Concern

- Estimated revenue shortfall for FY18 is Tk. 50,000 crore.

- The “fast track” projects are not implemented on time resulting in increased expenditure.

- Rising import payments resulting in negative balance of payment.

- Money laundering is apprehended to increase by over-priced imports.

- Inflationary pressure is increasing gradually due to high non-food inflation.

- Non-performing loans (NPL) is as high as 10%.

- Increasing current account deficit.

- Pressure on foreign reserves is mounting.

Recommendations

- Government should explore the possibilities of raising revenue from niche areas.

- The tax-free income ceiling should be raised to Tk. 3 lakhs with minimum tax rates going down to 7.5%.

- The financial and physical challenges to ADP implementation need especial attention.

- Dependency on the National Savings Certificate should be avoided.

- Legal framework to deal with non-performing loans (NPL) needs to be established.

- Institutional investors need to play a more responsible role in the capital market.

- Import payments, flow of foreign funds and their implication on the exchange rate, future debt servicing and import obligations need effective monitoring.

- Unfinished reform agenda should be completed. Public Expenditure Review Commission, permanent Local Government (Finance) Commission, Agriculture Costs and Prices Commission, Independent Financial Sector Reform commission and Statistical Commission should be established.