Stagnant private investment and inadequate employment creation are becoming giant hurdles for the Bangladesh economy. To achieve 7.4 percent GDP growth target, Bangladesh will need an additional BDT 66,000 crore in private investment. The government should expedite setting up Special Economic Zones (SEZs) to attract greater private and foreign investment which will contribute to creating more jobs. It should also focus on designing and implementing an appropriate employment policy which prioritises on ensuring decent work in the economy.

These observations emerged at the CPD Budget Dialogue 2017 held at Lakeshore Hotel on 17 June 2017. The dialogue was organised as part of the Independent Review of Bangladesh’s Development (IRBD), CPD’s flagship programme. Professor Rehman Sobhan, Chairman, CPD chaired the event.

Dr Fahmida Khatun, Executive Director, CPD identified the budget’s strengths and weaknesses while presenting the keynote on the analysis of the proposed National Budget FY2017-18. The presentation focused on the investment and employment outlook in Budget FY 2018, a detailed analysis on implementing the VAT and SD Act 2012, changes in ADP expenditure trends, allocations for the agriculture and social sectors and if the fiscal measures are biased towards revenue generation.

Dr Fahmida Khatun, Executive Director, CPD identified the budget’s strengths and weaknesses while presenting the keynote on the analysis of the proposed National Budget FY2017-18. The presentation focused on the investment and employment outlook in Budget FY 2018, a detailed analysis on implementing the VAT and SD Act 2012, changes in ADP expenditure trends, allocations for the agriculture and social sectors and if the fiscal measures are biased towards revenue generation.

In her concluding remarks, Dr Khatun highlighted that enhancing the delivery efficiency of the budget depends on the ‘right’ political economy alongside having a sound administrative framework. She stressed on setting up an independent Public Expenditure Review Commission for greater transparency in the government’s asset acquisition and on deeply involving parliamentary standing committees in the budget implementation process to establish an effective result based monitoring mechanism. Among other recommendations, Dr Khatun called for establishing an independent Financial Sector Reform Commission for recovering from the challenges that the banking sector currently faces.

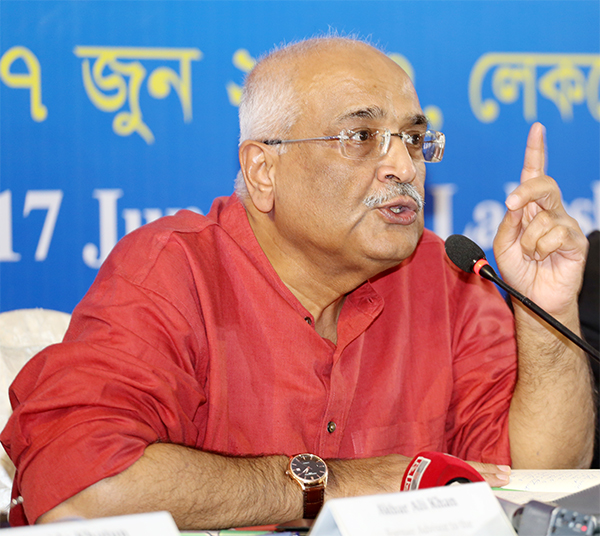

Following the presentation, discussant Dr Akbar Ali Khan, former Advisor to the Caretaker Government noted that the government’s decision to impose both VAT and excise duties contradicts tax principles with discouraging implications for consumers and producers. The proposed taxes also stimulated discussion on the widespread tax evasion culture in Bangladesh and arbitrary measures that the tax authority undertakes.

With allocations set aside in the proposed budget for recapitalizing ailing state-owned banks (SoB), Dr Khan also highlighted that Bangladesh’s poor practice for doing so dated back to the early 1990s and raised serious concerns. Professor Rehman Sobhan, Chairman, CPD perceived this disturbing trend as a political problem that receives political patronage. There is a need to look at these investments using a public expenditure lens, evaluate the likely opportunity costs accumulated over the years and privatise the banks. Professor Mustafizur Rahman, Distinguished Fellow, CPD added that between 2009 and 2016, about BDT 11,000 crore—10 percent of the additional revenue generated during the period—was used to recapitalize the SoBs.

Participants at the session drew attention to low levels of private investment, the questionable quality of public investments and dismal allocations for the education and health sectors.

With Bangladesh’s private investment-GDP ratio hovering around 22 percent for the past few years, Dr Debapriya Bhattacharya, Distinguished Fellow, CPD compared the economy’s growth to a “single-engined aircraft” that relies heavily on public investments. In response, Mr A H M Mustafa Kamal, MP, Hon’ble Minister for Planning, the Chief Guest at the event pointed out that private investment had not fallen in monetary terms. He added that many economies worldwide had progressed with yet lower private investment-GDP ratios.

With Bangladesh’s private investment-GDP ratio hovering around 22 percent for the past few years, Dr Debapriya Bhattacharya, Distinguished Fellow, CPD compared the economy’s growth to a “single-engined aircraft” that relies heavily on public investments. In response, Mr A H M Mustafa Kamal, MP, Hon’ble Minister for Planning, the Chief Guest at the event pointed out that private investment had not fallen in monetary terms. He added that many economies worldwide had progressed with yet lower private investment-GDP ratios.

Mr Amir Khosru Mahmud Chowdhury, former Commerce Minister, questioned the government’s excessive emphasis on mega-infrastructure projects. While he conceded that such ventures were important, Mr Chowdhury pointed out that these were carried out at the expense of improving Bangladesh’s education and health sectors. Also with big cost overruns due to slow implementation, the mega infrastructure projects opened avenues for corruption.

Mr Chowdhury’s remarks prompted the Special Guest Mr M A Mannan MP, Hon’ble State Minister for Finance and Planning to underscore that megaprojects are essential for ensuring better connectivity among various parts of Bangladesh.

Participants also focused on the likely foreign exchange crisis Bangladesh faces with huge dips in remittance and weak export growth.

Dr Muhammad Abdur Razzaque, MP, Chairman, Parliamentary Standing Committee on Ministry of Finance was also a Guest of Honour at the dialogue. Policymakers, bureaucrats, diplomats, political leaders, trade-leaders, economists, development practitioners, journalists and students attended the event and contributed to the discussion.